company

our performances

![]() PRODUCTS

PRODUCTS

![]() PV

+

PV

+

![]() QUALITY

MANAGEMENT

QUALITY

MANAGEMENT

references

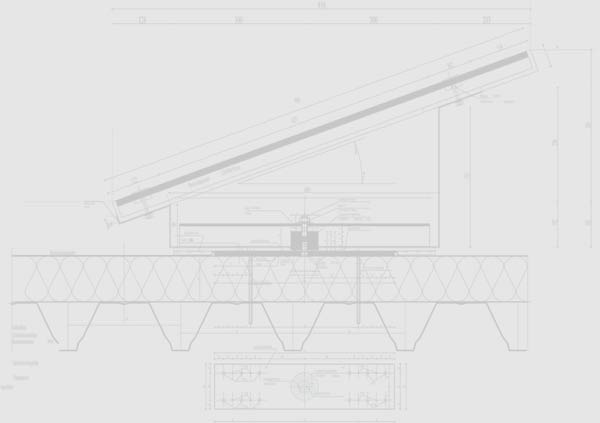

SOLUTIONS FOR SLOPE ROOFS

![]() With any kilowatt hour of environmental-friendly power produced, the carbon

dioxide emission is reduced by 0,7 kilograms.

With any kilowatt hour of environmental-friendly power produced, the carbon

dioxide emission is reduced by 0,7 kilograms.

![]() This is only one of many convincing arguments for solar energy.

This is only one of many convincing arguments for solar energy.

![]() The use of solar energy is the source of energy for the future.

The use of solar energy is the source of energy for the future.

![]() Solar energy is

clean, reduces energy costs and is supported by attractive promotional programs.

Solar energy is

clean, reduces energy costs and is supported by attractive promotional programs.

![]() Solar energy is

a rewarding investment for the environment and your purse.

Solar energy is

a rewarding investment for the environment and your purse.

![]() The perfect interplay

of reliable workmanship and the optimization of the system for the photovoltaic

plant planned and executed, is the most important advantage for the customer..

The perfect interplay

of reliable workmanship and the optimization of the system for the photovoltaic

plant planned and executed, is the most important advantage for the customer..

![]() Profit by our offer for all kinds of roof works and the competent advice,

planning and assembly of your solar plant.

Profit by our offer for all kinds of roof works and the competent advice,

planning and assembly of your solar plant.

![]() More and more often the own roof is used as a source of income:

More and more often the own roof is used as a source of income:

With a solar plant the roof produces clean electricity, which can be sold

at a guaranteed price, according to the law of renewable energy (EEG).

![]() Not each roof

is similarly suitable as a power station.

Not each roof

is similarly suitable as a power station.

![]() The location of

the building, possible shades, and the slope of the roof as well as the orientation

of the house is relevant.

The location of

the building, possible shades, and the slope of the roof as well as the orientation

of the house is relevant.

![]() The longest time

the sun is direction south: Therefore a roof lined up between south east and

south west can use best the warming sunbeams.

The longest time

the sun is direction south: Therefore a roof lined up between south east and

south west can use best the warming sunbeams.

A south oriented area with an inclination of about 30 degrees, therefore has

an optimal yield.

![]() Ventilation: There must be a special distance between the

modules and the roof area that a ventilation is guaranteed.

Ventilation: There must be a special distance between the

modules and the roof area that a ventilation is guaranteed.

![]() With increasing

temperature the degree of effectiveness of the cells decreases.

With increasing

temperature the degree of effectiveness of the cells decreases.

![]() So

that your investment can be calculated by today, the law for renewable energy

(EEG) guarantees a firm compensation to the operators of solar plants for

any kilowatt hour fed into the net, for 20 years.

So

that your investment can be calculated by today, the law for renewable energy

(EEG) guarantees a firm compensation to the operators of solar plants for

any kilowatt hour fed into the net, for 20 years.

![]() The KFW bank offers loans at a favourable rate of interest to operators of

solar plants. You have to make an application to the bank to which you present

your offer.

The KFW bank offers loans at a favourable rate of interest to operators of

solar plants. You have to make an application to the bank to which you present

your offer.

![]() As the operator of a photovoltaic plant you are responsible for the payment

of the VAT. We recommend asking your tax consultant about the possibilities

of refund of the VAT or eventually about the lucrative deduction possibilities.

As the operator of a photovoltaic plant you are responsible for the payment

of the VAT. We recommend asking your tax consultant about the possibilities

of refund of the VAT or eventually about the lucrative deduction possibilities.